Arbitrage Is the Use of Discrepancies in Currency Exchange

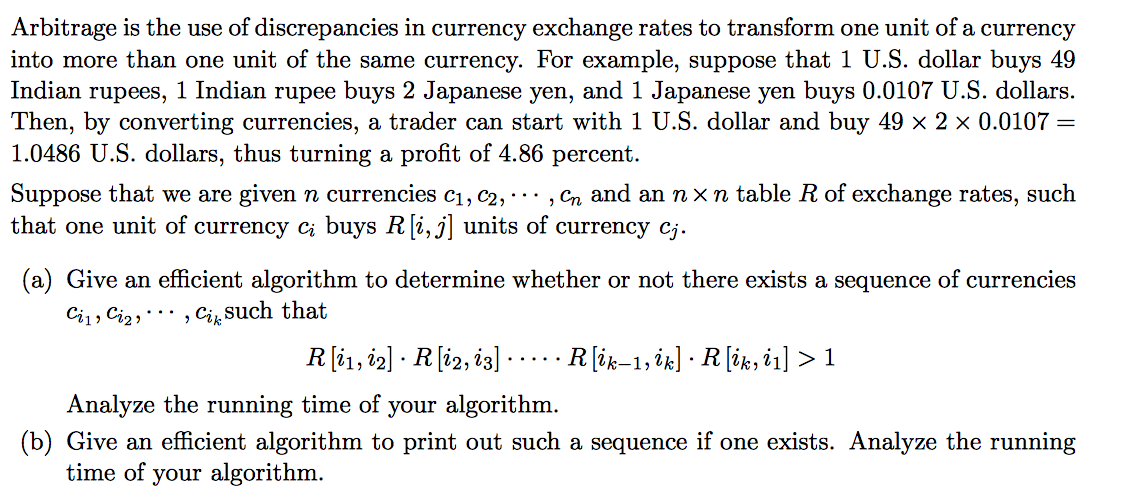

Arbitrage is a trading strategy in finance that is possible due to the inadequacies in a market. 24-3 Arbitrage Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the suppose that 1 US.

What Is Arbitrage Trading And How Does It Work Ig Uk

Dollar buys 464 Indian rupees 1 Indian rupee buys 25 Japanese yen and.

. Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the same currency. Support Arbitrage-Finder has a. Forex arbitrage involves identifying and taking advantage of price discrepancies that can arise in the valuation of one or more currency pairs.

Yet the chances of this type of opportunity coming up much less being able to profit from it are remote. Then by converting currencies a trader can start with 1. Currency arbitrage strategies take advantage of currency price discrepancies.

Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the same currency. Protection And Security Of Your Funds Is Our Top Priority. This lands the trader in a position to benefit from the price discrepancies.

Find step-by-step Computer science solutions and your answer to the following textbook question. Some traders choose to call it spread trading instead of arbitrage. For example suppose that 1 US.

And currency arbitrage is no various. Dollar buys 464 Indian rupees 1 Indian rupee buys 25 Japanese yen and 1 Japanese yen buys 00091 US. Project for finding discrepancies in currency exchange rates such that at the end of a cycle you end with some number greater than which you started.

A future being an agreement to trade an instrument at a set date for a fixed price. Dollar buys 49 Indian rupees 1 Indian rupee buys 2 Japanese yen and 1 Japanese yen buys 00107 US. The stock on the overseas foreign exchange is valued lower compared to that on the domestic exchange.

In basic words we can say it means buying and selling currency from different brokers or markets to. Answer of Arbitrage is the use of discrepancies in currency-exchange rates to make a profit. For example there may be a small window of time during which 1.

Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the same currency. Get a Quote Today. Then by converting currencies a clever trader can start with 1 US dollar and buy.

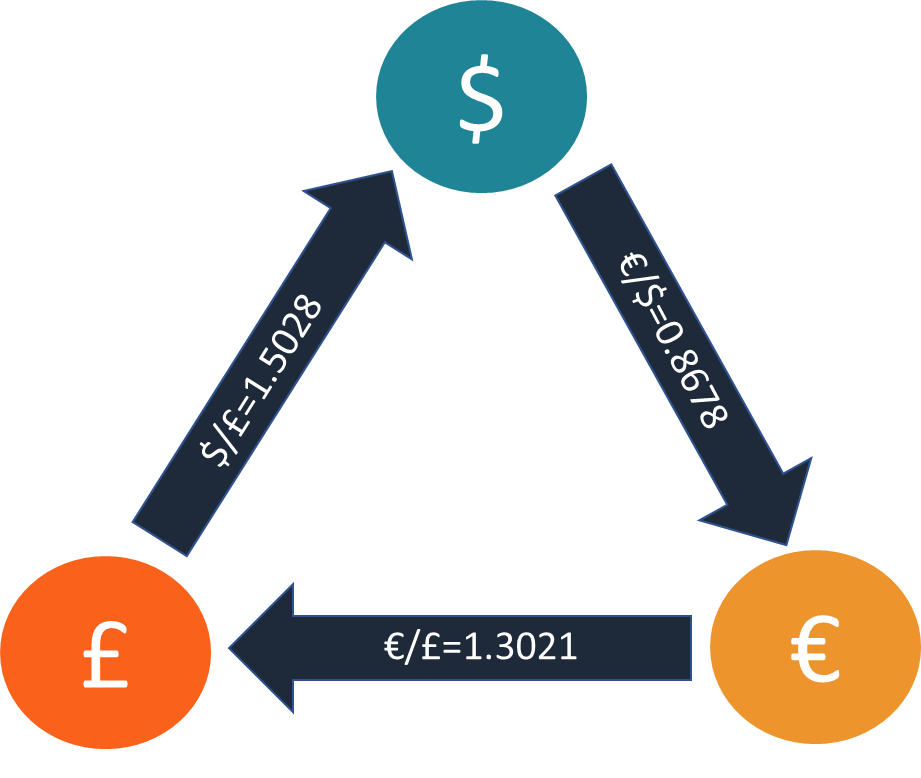

Arbitrage in the world of finance refers to a trading strategy that takes advantage of irregularities in a financial market. For example suppose that 1 US Dollar buys 05 British pounds 1 British pound buys 100 French francs and. One approach may involve looking for discrepancies between spot rates and currency futures.

Dollar buys 464 Indian rupees 1 Indian rupee buys 25 Japanese yen and. Arbitrage Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the same currency. For example suppose that 1 US.

Dollar buys 464 Indian rupees 1 Indian rupee buys 25 Japanese yen and. Dollar bought 082 Euro 1 Euro bought 1297 Japanese Yen 1 Japanese Yen bought 12 Turkish Lira and one Turkish Lira bought 00008 US. Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the same currency.

Forex broker arbitrage may occur when two different brokers are offering different quotes for the same currency pair. The traders who make use of arbitrage opportunities are known as. Consider a person who starts with some amount of currency X goes through a series of exchanges and finally ends up with more amount of X than he initially had.

Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the same currency. Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the same currency. Then by converting currencies a trader can start with 1 US.

For example suppose that 1 US Dollar buys 05 British pound 1 British pound buys 100 French francs and 1 French franc buys 021 US dollar. Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the same currency. Statistical arbitrage in forex involves looking for profit opportunities that arise as a result of discrepancies in exchange rates as determined by predicted or historical norms.

With triangular arbitrage the aim is to exploit discrepancies in the cross rates of different currency pairs. Consider a person who starts with some amount of currency X goes through a series of exchanges and finally ends up with more amount of Xthan he initially had. Given n currencies and a table nxn of exchange rates devise an algorithm that a person.

Arbitrage is the process of using discrepancies in currency exchange values to earn profit. Currency Arbitrage Problem Arbitrage is the process of using discrepancies in currency exchange values to earn profit. For example suppose that 1 US.

Dollar buys 49 Indian rupees 1 Indian rupee buys 2 Japanese yen and 11 Japanese yen buys 00107 US. Arbitrageurs look to exploit price anomalies for profit. Currency arbitrage involves the exploitation of the differences in quotes rather than movements in the exchange rates of the currencies in the.

Trading textbooks always talk about cross-currency arbitrage also called triangular arbitrage. For example suppose that 1 US. However in the retail.

Solved Expert Answer to Arbitrage is the use of discrepancies in currency exchange rates to transformone unit of a currency into more than one unit of the same curren Get Best Price Guarantee 30 Extra Discount. For example suppose that 1 US. The general characteristic of real arbitrage is a risk free profit but achieving this result usually involves.

In this a currency trader take advantage of the price difference in quotes by numerous brokers or in a different market to earn a profit. Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the same currency.

Triangular Arbitrage Wikipedia

Solved Arbitrage Is The Use Of Discrepancies In Currency Chegg Com

No comments for "Arbitrage Is the Use of Discrepancies in Currency Exchange"

Post a Comment